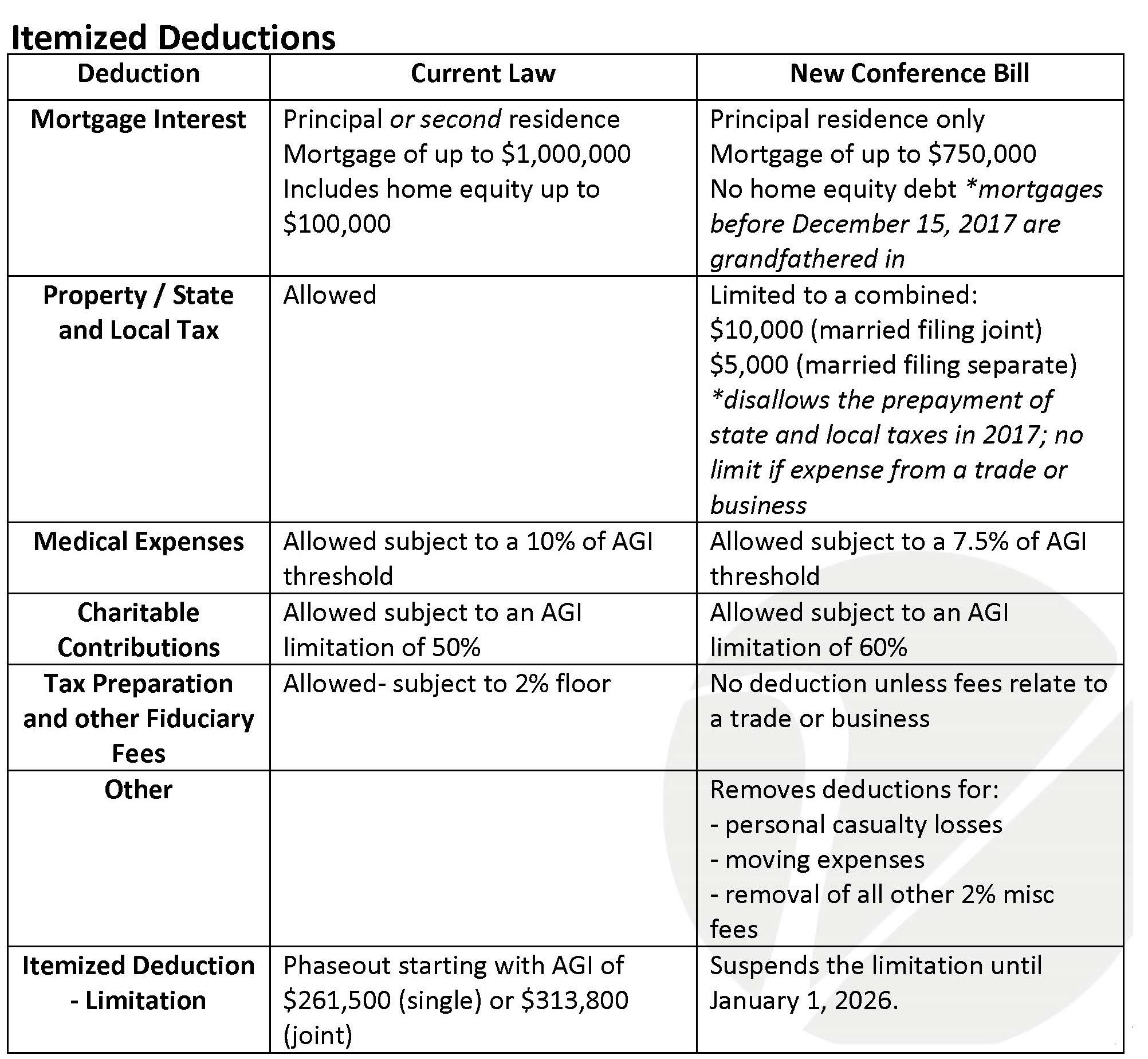

Specifically the tcja suspended for 2018 through 2025 a large group of deductions lumped together in a category called miscellaneous itemized deductions that were deductible to the extent they exceeded 2 of a taxpayer s adjusted gross income.

Subject to 2 agi floor.

2 000 1 500 2 of 75 000.

Products offered only at participating offices.

The amount of a s business meal expenses.

Deductible expenses subject to the 2 floor includes.

In 2017 and earlier tax years wage earners and other taxpayers who weren t able to write thes.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

1 year delay in treatment of publicly offered regulated investment companies under 2 percent floor pub.

Expenses for uniforms and special clothing.

100 203 title x 10104 a dec.

Subtract 2 of his agi from his deductions that are subject to the rule.

Line of credit subject to credit and underwriting approval.

22 1987 101 stat.

For 1987 a a member of congress has adjusted gross income of 100 000 and miscellaneous itemized deductions of 10 750 of which 3 750 is for meals 3 000 is for other living expenses and 4 000 is for other miscellaneous itemized deductions none of which is subject to any percentage limitations other than the 2 percent floor of section 67.

His miscellaneous itemized deductions total 2 000.

The following are itemized deductions subject in total to the 2 rule described above.

What are miscellaneous itemized deductions.

Promotional period 11 14 2019 1 10 2020.

Jerry s agi is 75 000.

Under knight fees paid to an investment adviser by a nongrantor trust or estate are generally miscellaneous itemized deductions subject to a floor of 2 of adjusted gross income agi rather than fully deductible as an expense of administering an estate or trust under sec.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

If he itemizes his deductions he can claim a 500 deduction for his miscellaneous items.

All products subject to id verification.

These include the following deductions.

This publication covers the following topics.

These are work related.

Unreimbursed employee business expenses such as.

The supreme court held that the latter provision limits its.

Job hunting expenses for a position in the same trade or business.

If approved for an emerald advance your credit limit could be between 350 1000.

1330 386 provided that.